5 Steps to a Successful Nonprofit Year-End

The end of the year is often the busiest time of the year for nonprofit organizations. It’s a time of generosity when people from all walks of life give back to their communities. This means nonprofit professionals work hard, planning their year-end campaigns to make the most of this surge in generosity and provide supporters with all of the information they need to make an impact on the organization’s mission.

Even amidst this preparation and planning for fundraising campaigns, the end of year is also an essential time to make sure your organization’s finances are in order. There are several bookkeeping and accounting deadlines that conclude with the calendar year.

Make sure your organization is prepared for the year to wrap up by taking the following steps:

- Gather information for 1099s.

- Send any necessary donor acknowledgments.

- Record any in-kind donations.

- Remind staff to update their contact information.

- Report any necessary grant information.

In this guide, we’ll dive into details about each of these year-end activities. Remember that it’s best for your organization to prepare as much as possible for your fundraising activities and accounting activities throughout the year so you don’t end up scrambling at the end of the year to get everything in order.

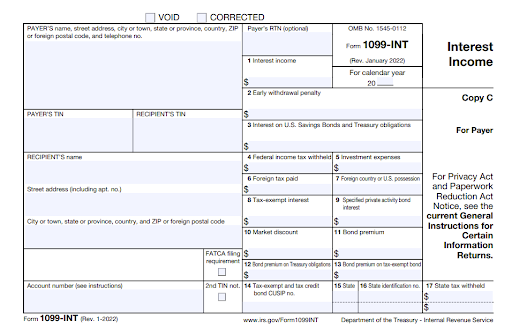

1. Gather Information for 1099s

The Form 1099 is similar to the W2 that you provide to employees, but it’s meant for your organization’s contractors. While you technically won’t need to send these forms until January 31, you should make sure you have the information necessary to issue these forms before the start of the new year.

First, make sure you know who you need to send 1099s to. Jitasa’s guide to Form 1099s for nonprofits provides the following four conditions that must be met for a vendor or contractor to require a 1099:

- Your nonprofit made a payment to someone who is not your employee

- The payment was made for a service to help the nonprofit organization

- Your nonprofit made the payment to an individual, partner, vendor, or estate

- The payment amounted to at least $600 during the year

Once you identify who will need to be issued this form, be sure you have the most up-to-date information about your vendors to send them their 1099. This means you’ll need to make sure you have their correct mailing address, name, social security number, and other information they submit on a W-9. Outside of the information on the W-9, you’ll also need to pull the category of the payment, an account number, and tax withholding information for each vendor.

As we mentioned, be sure you have everything you need to issue your 1099 forms before the new year begins. This will help you issue them earlier in January, reducing stress as you wind down from the frenzy of year-end activities.

2. Send Any Necessary Donor Acknowledgment Letters

When a donor gives $250 or more in one calendar year, your organization is required to send a donor acknowledgment letter by the year’s end. It’s best practice to send these letters as soon as the gift is contributed. However, it’s easy to fall behind on these letters and end up with a pile of them to send by December 31. Sending a letter to any donor who has made more than one gift in the calendar year is also a great practice.

In general, these letters are not required for contributions made in which your organization provides goods or services in return. However, there are exceptions to the rule, so do some research about your own membership dues or service fees to be sure you don’t miss important acknowledgments.

Donor acknowledgment letters are essential for your donors to claim tax deductions for the gifts they contribute to your organization.

Therefore, the IRS requires each gift acknowledgment letter to include the following information:

- Your donor’s name.

- The legal name and EIN of your nonprofit.

- A statement regarding your organization’s 501(c)(3) status.

- The date you received the donation.

- The amount donated to your organization.

- If applicable:

- A statement that your nonprofit didn’t provide goods or services in exchange for the contribution.

- A description and good faith estimate of in-kind contributions made to your organization.

- A statement that any goods or services provided by your organization in exchange for the donation were intangible religious benefits.

Keep in mind that gifts exceeding $250 may also come in during your year-end giving season. Generally speaking, between 30-40% of donations are contributed during the final quarter of the calendar year.

Therefore, prepare the gift acknowledgment letters before the end of the year. Then, immediately following the year-end giving season, you will be able to identify any donors whose total exceeds $250 (or who gave more than one donation) to send the required communications before January 31.

3. Record Any In-Kind Donations

Similar to donor acknowledgments, it’s easy to let the year slip by without immediately recording the in-kind donations that your organization receives, especially since they’re non-monetary contributions. Your nonprofit needs to record in-kind donations made to your organization as a part of the generally accepted accounting principles (GAAP) as well as for accurate annual tax forms.

Before the end of the year, be sure you’ve recorded and confirmed all in-kind donations made throughout the year in your system of accounts and the date they were donated. This means that you’ll be pulling up-to-date information when you compile accounting reports about your organization’s revenue and expenses from the year. To do so, you’ll need to determine the value of the in-kind donation contributed.

The value of some gifts may be easier to determine than others. If it’s a tangible item with the tags still on it, you can assume the value will match the tags. If the actual price is not available, you could research what price you could get for the item on the open market. However, if it’s used, you might need to determine the depreciation of the item when you value it. When the item is donated, you can also ask the donor to complete a form listing the details of the items given and their estimated market value.

Services can be some of the most challenging in-kind donations to assign a value. Knowing what you would typically pay for such services if they were not donated is the first step to deciding how to value these services. You can also ask the donor what they would typically charge. These two numbers might not be the same.

Let’s take a look at a likely scenario that addresses how you’ll assign values to two types of in-kind donations. Consider that your nonprofit accepted a gift of new chairs that you’ll use at your next nonprofit event. Those chairs will be valued at the same level as the price indicated on the tag. For the same event, an event planner offered their services in kind to help prepare for the event itself. Consider the fair market value of the event planners work per hour, then calculate the number of hours they worked with your organization to determine the value of their services for your records.

Knowing how to put an accurate value on in-kind donations can help you maintain your records throughout the year. Then, when the end of the year rolls around, you can make sure all in-kind donations are accounted for, so you can accurately report them and avoid any complications.

4. Remind Staff to Update Their Contact Information

Just as your organization needs to submit your annual tax reports at the beginning of the new year, your staff members must pay their taxes early after the year’s end. Just as you confirmed that you had everything you needed from your vendors and contractors, you should make sure you have all of the necessary information to send W-2s to your staff members.

This means you’ll need to remind your staff to update their contact information before the year ends so that they can receive this important tax document.

If you use an HR payroll system for employee compensation, this is where you’ll need to ensure their information is up-to-date. Remind them to confirm their information before the end of the year, and preferably before the giving season starts ramping up too much.

5. Report Any Necessary Grant Information

In addition to raising money from individuals, many organizations rely heavily on grants for their fundraising efforts. The issue is that accepting more than one grant can make reporting standards challenging to keep up with.

This is why it’s so important to set up a system to manage your grants and grant deadlines. Be sure you record when you need to have reports back to your funders and what needs to be included in those reports.

Often, grantors use the calendar year for their reporting deadlines, requiring your organization to report the use of your grants by the end of the year. This may not always be the case, but it’s worth checking your own grant requirements to be sure you’ll meet the deadlines they set, even during the busiest time of year.

To make sure you’re reporting everything accurately and on time, we suggest taking the following steps:

- Determine if each grant is unconditional, has contingencies, or is reimbursable. Then, record the grant monies accordingly

- Set up reminders prior to your deadlines so that you have time to gather all information about your use of the grants

- Prepare grant reports early before the year’s end and make any final adjustments before you send them off to save time during the year end activities

Your staff members are busy at the end of the year. It can be challenging to pull grant reports on top of holiday planning, fundraising campaigns, family time, and everything else. The best solution is to make sure you’re properly recording grant monies used throughout the year instead of pulling it all together at the last minute.

The end of the year is a time of joy and giving. For nonprofits, that means it’s one of the most important and busiest times. It’s easy to feel overwhelmed and start scrambling to get all your year-end tasks completed in time. Take a deep breath, create your year-end checklist, and be sure to address all the areas we covered in this article. Start preparing early and you’ll find it’s easy to make sure everything is done in time. Good luck!

Updated: November 15, 2022